Paying by Check? Think Again.

Scam artists are intercepting paper checks in the mail and stealing your money. But there are precautions to take.

While technology can help scammers find and persuade their potential victims, it can also help you protect yourself from common frauds—like checks that are stolen and "washed."

Consider this story: When Mary H.,* who lives near San Diego, pays bills by check, she mails them from one of the U.S. Postal Service’s secure mailboxes. And she uses thick envelopes that mask the outlines of the check inside.

Despite those precautions, a $24.17 check Mary mailed last year to cover a medical bill was intercepted by a thief somewhere along the delivery route. That paper check was then "washed"—meaning it was treated with chemicals or run through a device to remove the recipient’s name and the dollar amount Mary had written in ink. A new value—$8,600.22—and payee name were written in their place. Mary caught the pending transaction on her online statement and reported it to her bank, which was able to stop the transaction.

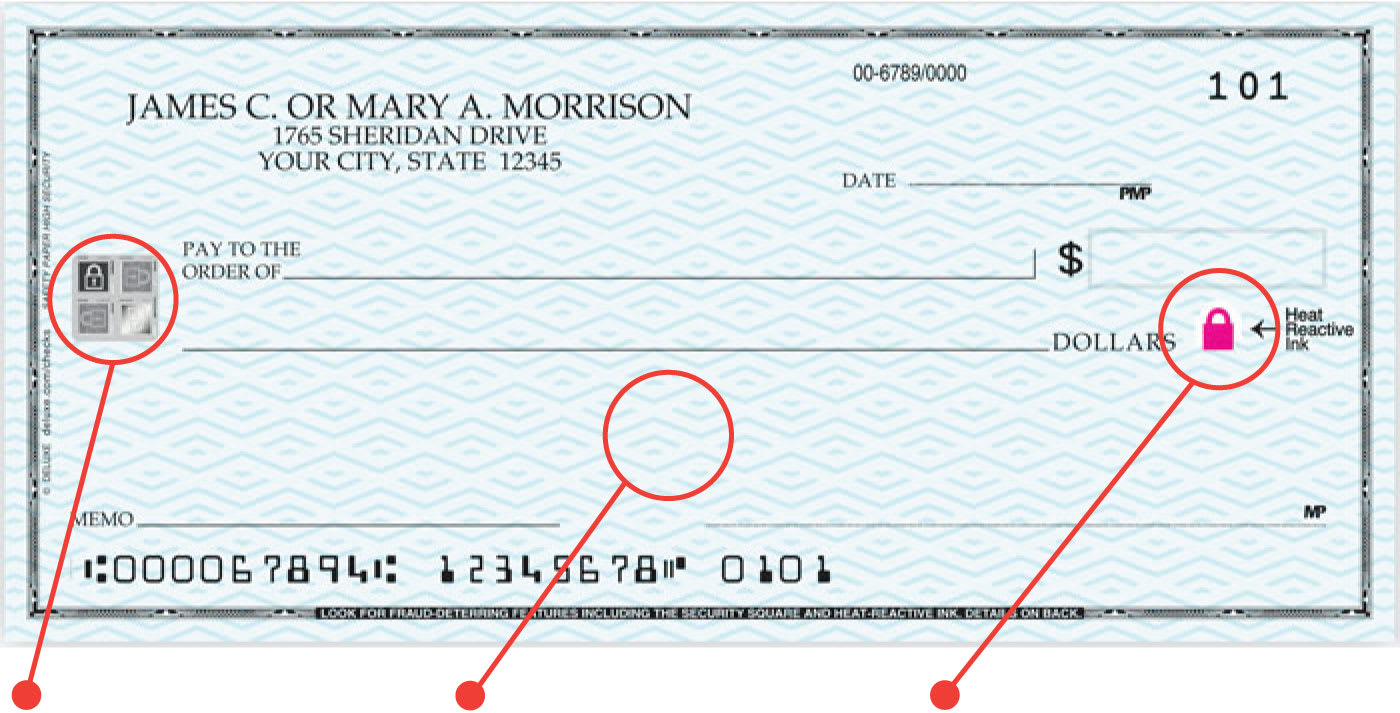

Invisible patterns and reflective images are very hard to reproduce.

Some parts of the check will reveal a visual change if a scammer tries to wash it.

These may change color or become visible when exposed to chemicals or heat.

Editor’s Note: This article also appeared in the March 2025 issue of Consumer Reports magazine.

Our work on privacy, security, AI, and financial technology issues is made possible by the vision and support of the Ford Foundation, Omidyar Network, Craig Newmark Philanthropies, and the Alfred P. Sloan Foundation.

*Last name withheld at the individual’s request.